Fifty companies were randomly sampled from the 500 companies in the S&P 500, and their financial information was collected on March 8, 2012.

Format

A data frame with 50 observations on the following 12 variables.

- market_cap

Total value of all company shares, in millions of dollars.

- stock

The name of the stock (e.g.

AAPLfor Apple).- ent_value

Enterprise value, which is an alternative to market cap that also accounts for things like cash and debt, in millions of dollars.

- trail_pe

The market cap divided by the earnings (profits) over the last year.

- forward_pe

The market cap divided by the forecasted earnings (profits) over the next year.

- ev_over_rev

Enterprise value divided by the company's revenue.

- profit_margin

Percent of earnings that are profits.

- revenue

Revenue, in millions of dollars.

- growth

Quartly revenue growth (year over year), in millions of dollars.

- earn_before

Earnings before interest, taxes, depreciation, and amortization, in millions of dollars.

- cash

Total cash, in millions of dollars.

- debt

Total debt, in millions of dollars.

Examples

library(ggplot2)

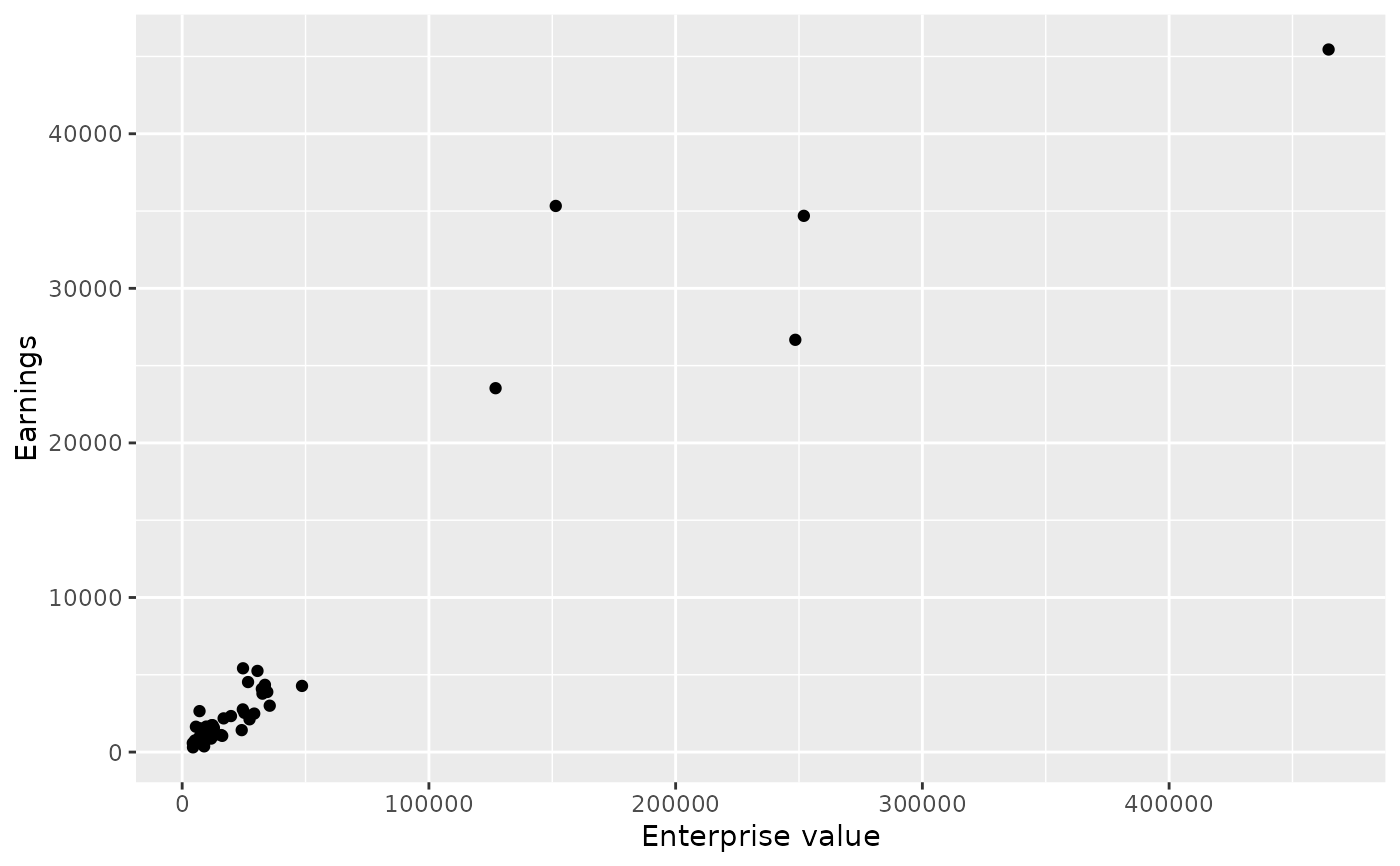

ggplot(sp500, aes(x = ent_value, y = earn_before)) +

geom_point() +

labs(x = "Enterprise value", y = "Earnings")

#> Warning: Removed 3 rows containing missing values or values outside the scale range

#> (`geom_point()`).

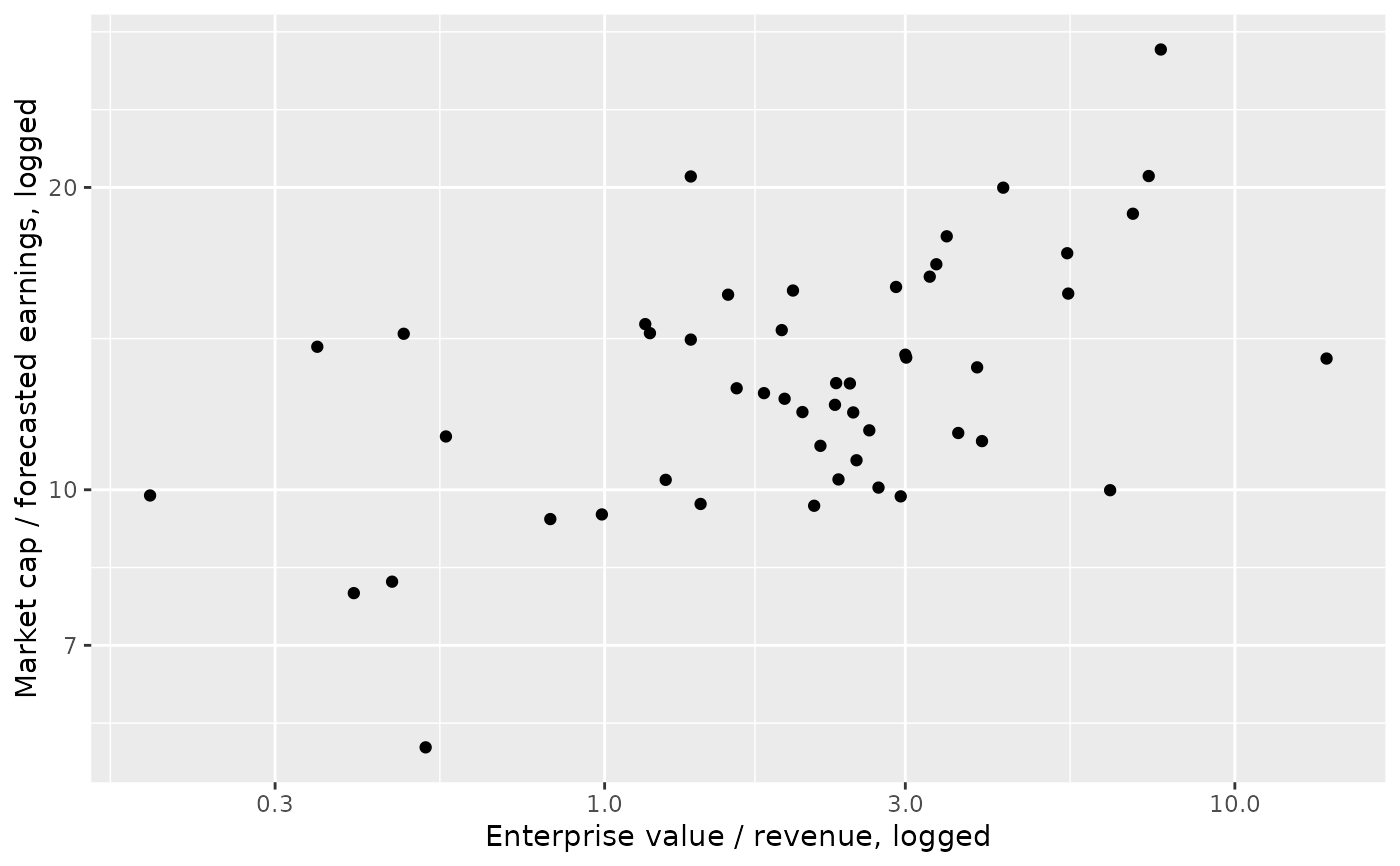

ggplot(sp500, aes(x = ev_over_rev, y = forward_pe)) +

geom_point() +

labs(

x = "Enterprise value / revenue, logged",

y = "Market cap / forecasted earnings, logged"

)

ggplot(sp500, aes(x = ev_over_rev, y = forward_pe)) +

geom_point() +

labs(

x = "Enterprise value / revenue, logged",

y = "Market cap / forecasted earnings, logged"

)

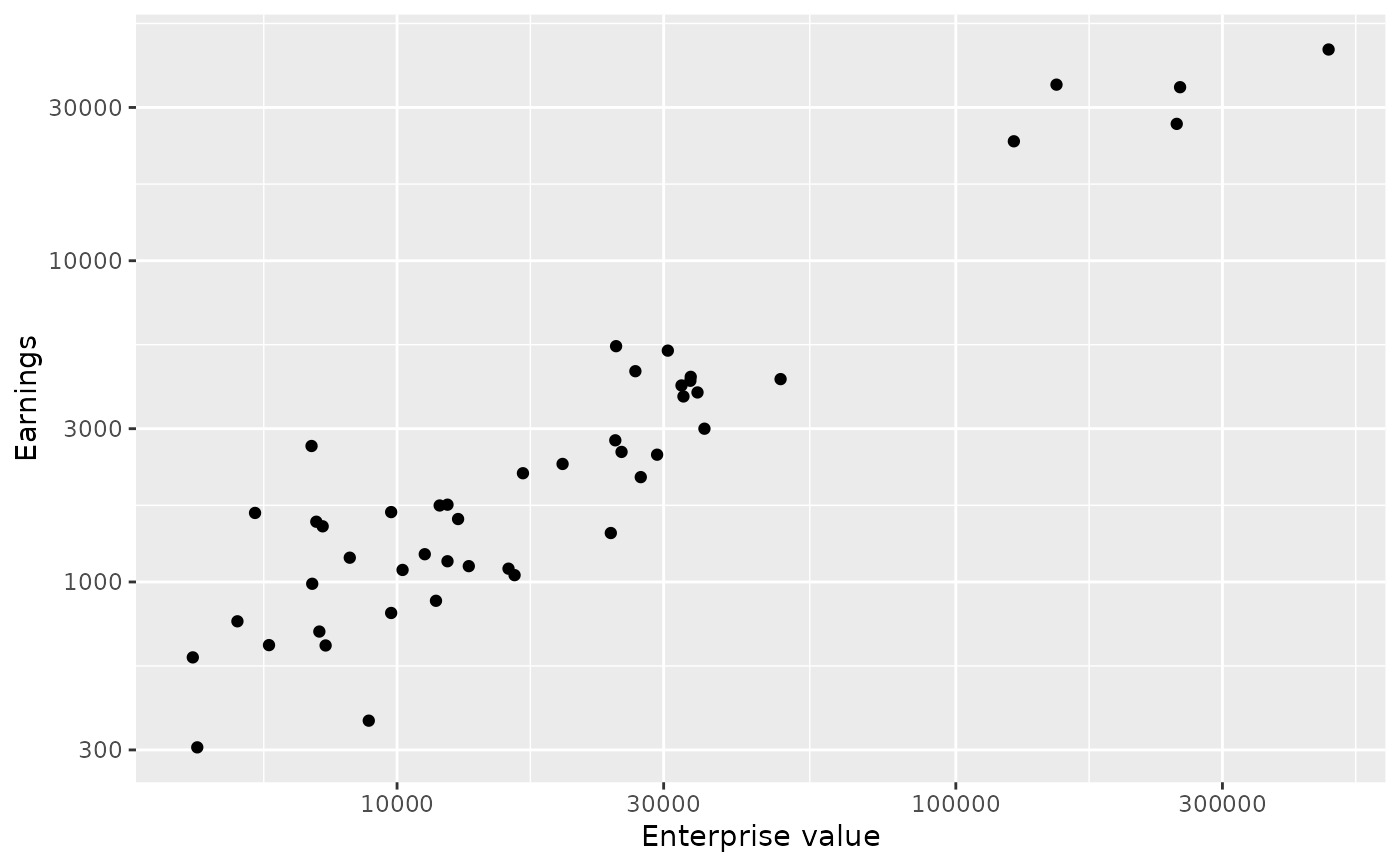

ggplot(sp500, aes(x = ent_value, y = earn_before)) +

geom_point() +

scale_x_log10() +

scale_y_log10() +

labs(x = "Enterprise value", y = "Earnings")

#> Warning: Removed 3 rows containing missing values or values outside the scale range

#> (`geom_point()`).

ggplot(sp500, aes(x = ent_value, y = earn_before)) +

geom_point() +

scale_x_log10() +

scale_y_log10() +

labs(x = "Enterprise value", y = "Earnings")

#> Warning: Removed 3 rows containing missing values or values outside the scale range

#> (`geom_point()`).

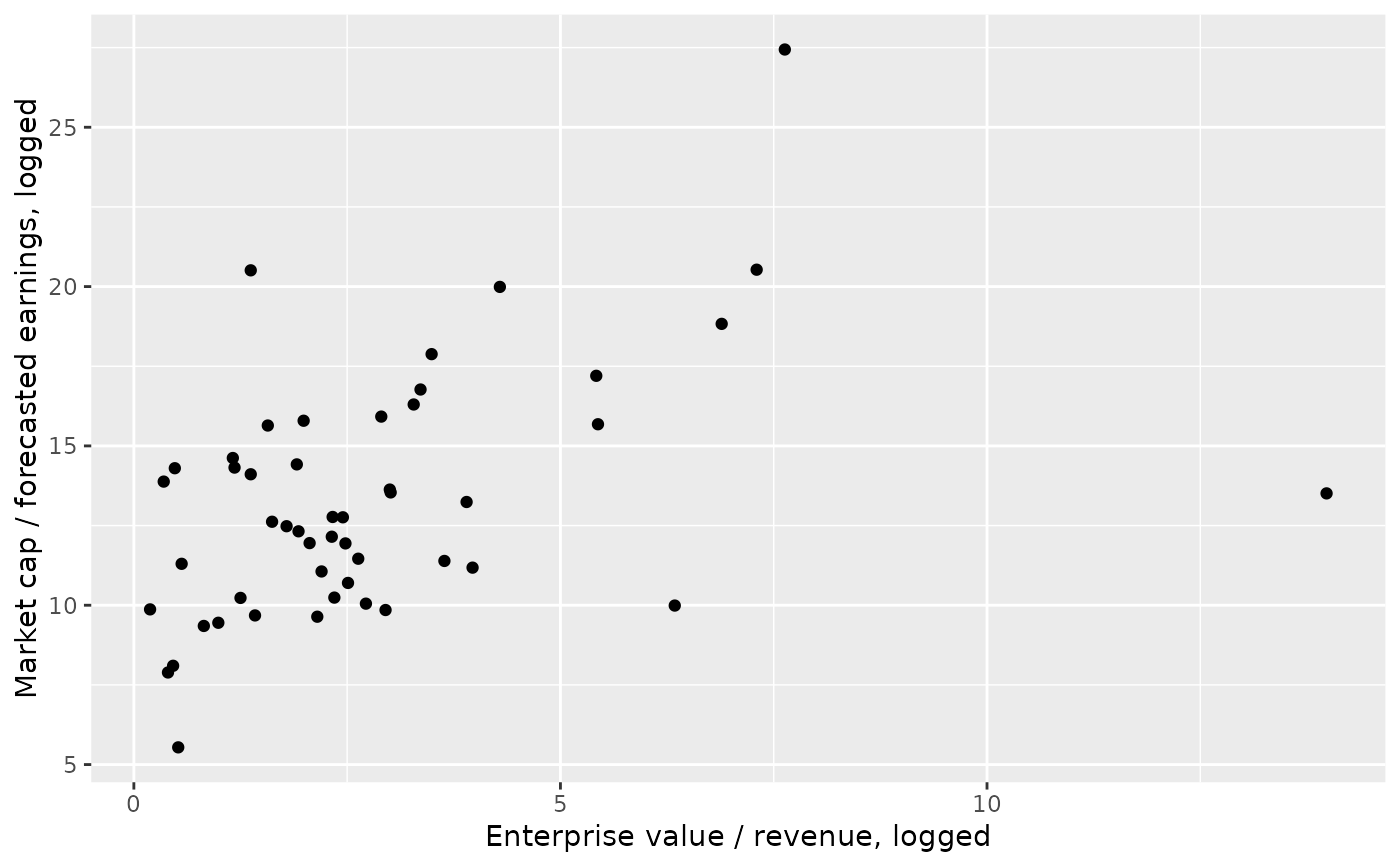

ggplot(sp500, aes(x = ev_over_rev, y = forward_pe)) +

geom_point() +

scale_x_log10() +

scale_y_log10() +

labs(

x = "Enterprise value / revenue, logged",

y = "Market cap / forecasted earnings, logged"

)

ggplot(sp500, aes(x = ev_over_rev, y = forward_pe)) +

geom_point() +

scale_x_log10() +

scale_y_log10() +

labs(

x = "Enterprise value / revenue, logged",

y = "Market cap / forecasted earnings, logged"

)